What Bank Can I Withdraw Money From My Emerald Card

Emerald is a prepaid debit card that operates like any other debit card. You can send money to other people, buy goods online, pay bills, and transfer money to a bank account. I will show you how to transfer money from an Emerald card to my bank account later. Having a prepaid card that allows you to transfer money to your bank account is important to save money for future use or do other kinds of transactions in your bank account.

Advertisements MetaBank issues the Emerald card for use in tax refund-related deposits. It is a MasterCard and allows you to access your funds at ATMs that allow MasterCard cards. Being issued by a bank means that it has FDIC insurance. FDIC insurance ensures that you do not lose your money if the concerned financial institution collapses. The law requires that every bank insures every account operating under them.

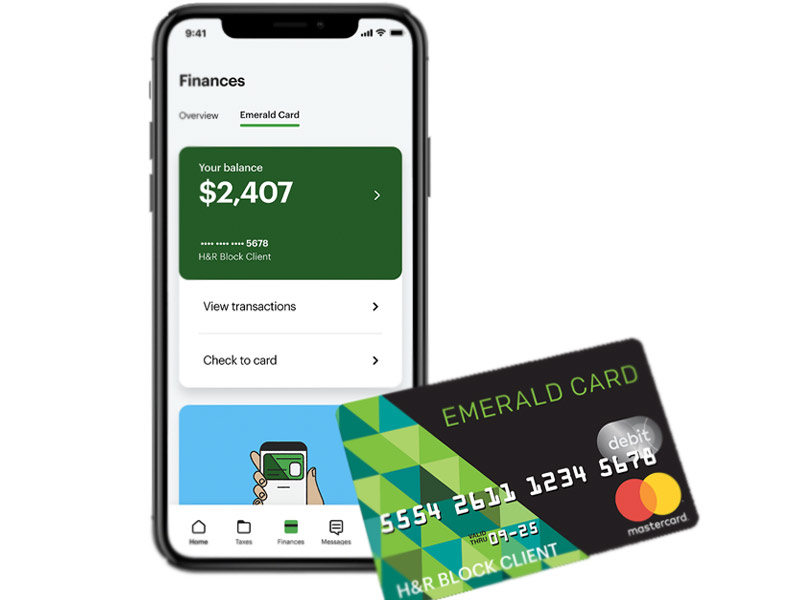

Emerald card allows you to operate your account online via the MyBlock mobile app. That gives you an easy access to your funds so that you can carry out your transactions with just a few taps. With an online account, you can see your card balance as well as view your transaction history. There is no essence to visit an ATM for such simple operations, nor will you see the need to call your customer care for your balance inquiry.

How do I apply for the Emerald card?

You can apply for the card online for the prequalification process. You need your;

- Social Security Number,

- Personal contact information, and

- Last year's tax refund amount

Personal information includes your email address, your phone number, and the physical address.

The card allows you to obtain an Emerald Advance of between $350-$1000, depending on the available credit scores. To apply for the card, you need to be over 18 years of age and above.

Once you apply for the debit card, you will wait for delivery via your physical address. You will then activate it once you receive it by calling the Emerald Card helpline at 1-866-353-1266. You will also have to set up an online account to manage your funds via the MyBlock mobile app.

Why is the Emerald card necessary?

The card is very beneficial to those who would like to receive the H&R Block tax refund advance loans. The company offers the loans at the beginning of every tax season, and one must have the Emerald prepaid MasterCard where the loan has to be deposited. You cannot get the loan via a check or direct deposit.

H&R Block offers loans in five loan amounts which are $250, $500, $750, $1,250 and $3,500. The biggest advantage of H&R Block is that they attract a 0% APR on the loans. We all know that many lenders usually charge interest on their loans. Some are so greedy that they charge very high interest rates, thus leaving the borrowers financially drained. However, you must file your taxes via H&R Block and pay the necessary fees to qualify for the advance loans.

The Emerald card attracts various fees despite being so crucial if you use it like a regular debit card. You have to pay $3.00 per ATM withdrawal and $1.50 for every balance inquiry or decline. The ATM service provider may also charge you other fees.

If you stay for 60 days without using the card, you will get a slap of a $4.95 monthly fee. The card issuer also charges you a cash reloading fee of up to $4.95. If you use the card to pay bills, you will have to part with 95 cents.

How to Transfer Money from Emerald Card to my bank account

You can transfer money from your Emerald card to your linked bank account. Remember you should link your card to a bank account when you apply. This is usually a checking account that you use for your day-to-day transactions.

Linking a bank account to your Emerald prepaid Mastercard, you need to navigate the add bank section and add your bank details, such as the account and routing number. Once you link your bank account successfully, you can transfer funds to the account when the need arises. You can then transfer money to someone else's bank account from your bank account or perform other kinds of transactions.

How do I get funds out of my Emerald card?

There are various ways on how you can get funds from your card. They include the following.

i) Via ATM

You can use your Emerald Prepaid MasterCard at any ATM with Maestro, Mastercard, or Cirrus brand mark. You may pay a withdrawal fee of $3 at some ATMs. Accessing money at an ATM point makes it possible to get cash when the need arises.

ii) Withdraw to a bank account

We have confirmed that it is possible to withdraw money to a bank account. It makes it possible to use your money for transactions that you cannot do with your card.

iii) Cashback at a store

You can receive cash back upon using the card at any qualifying store. The POS may charge you some fees for the transaction.

iv) Over the counter

You can use your card to get money out of your account at any financial institution that accepts the card. However, you will part with a $35.00 transaction fee. Withdrawing from an ATM can help you save around $32.

v) Request check or one time ACH

You can request a check from the card service provider to cash out at a bank if you need to withdraw large amounts that you cannot withdraw at an ATM. Requesting a one-time ACH ensures that the company transfers money from your card account to a bank account.

Is my money safe in the Emerald card?

Your money is safe at Emerald card since it is FDIC insured. You, therefore, will get your money back even if the company collapses. FDIC insures funds up to $250,000 per account. If the company collapses, then you can still have your money. MetaBank holds your money in your card, and since the bank has FDIC insurance, then the money in your card is insured of any uncertainty.

Furthermore, no one can steal from your card via an ATM withdrawal since the card has a PIN. When you get the card, you should check the PIN that comes with the card. You can even change it to your preferred one at an ATM. However, you should not expose the card details to anybody since some people can use the card info to pay for goods or services online.

If your card issuer detects some kind of fraud in your account, they may restrict your card so that no one can withdraw money from it. You will see the display "Account restricted" when you try to withdraw at an ATM. However, that is usually a temporary issue that is meant to protect you from losing your money. It is not only Emerald that does so, but other financial institutions such as credit unions, bank accounts, and mobile wallets usually impose such restrictions.

Does the Emerald card have limits?

The card issuer has set various limits to control the amount of money you can spend per given time. For instance, the maximum amount you can withdraw at an ATM is $3,000 per day. The amount is far much higher than that of other cards which keep it at $1,000. Therefore, that is an added advantage of having the Emerald card.

When carrying out any PIN transactions, the maximum amount you can spend is $3,500.00. The amount includes ATM withdrawals as well as POS authorization. For signature transactions, the maximum amount is $3500 per day.

Does the Emerald card have routing and account numbers?

Yes. The card has both the routing and account numbers. The routing number for the card is uniform for everyone, and if you need to provide it somewhere, it is 101089742. You need to provide the routing and the account number to trustworthy people and organizations for direct deposits.

Remember that some fraudulent individuals can use your account and routing number to order checks from the card issuer to pay at different areas. You can therefore lose money in such a manner.

The routing number and account numbers are available in your account when you sign in to your account online. You can also get your routing and account numbers by calling customer care. If you send money to someone else with an Emerald card, you only need the recipient's account number.

Even when you want to send money with a checking account number instantly from your bank account to another person's account, you will just need the account number and maybe the recipient's official name for confirmation.

Does the Emerald debit card expire?

The card expires just like other debit cards. Once it expires, you can't use it anymore, and therefore you have to order a new one. The new card comes with a different card number. You can order your Emerald Card by calling customer care at 1-866-353-1266. It is always good to order a new card before the old card expires to avoid any inconveniences.

Frequently Asked Questions (FAQS)

Can I purchase online with Emeralds?

Yes, you can buy online with your card. You can also pay at a physical store.

What happens when I lose my Emerald card?

If you lose your card, you should immediately report it to customer care to deactivate it. If you do not, someone may use the card fraudulently.

Does the Emerald card accept direct deposit?

Yes. The Emerald card accepts direct deposit, and you can give your routing and account number to your employer or any other relevant parties to put money in your account.

Can teenagers apply for the Emerald debit card?

The card is only for those 18 years and above. Therefore, teens cannot apply.

Does the Emerald card affect my credit score?

The card alone does not affect your credit scores. However, if you get the H&R Block loan, your scores will be affected.

Bottom line

The Emerald card is issued by Metabank, which has FDIC insurance. Therefore, your money is safe in the account. The card is a prepaid debit card that allows you to receive H&R Block advances. You can use the card to buy goods and services online, at a physical store, transfer money to a bank account, or withdraw at an ATM.

What Bank Can I Withdraw Money From My Emerald Card

Source: https://transfermone.com/transfer-money-from-emerald-card-to-my-bank-account/

Posted by: mcnultythisings.blogspot.com

0 Response to "What Bank Can I Withdraw Money From My Emerald Card"

Post a Comment